Next-Gen AI for Compliance Automation in the Banking Industry: Key Trends for 2025

The banking industry is facing an unprecedented convergence of challenges and opportunities. Increasingly complex regulations, rising customer expectations, evolving cyber threats, and the exponential growth of financial data have made compliance a strategic priority. In 2025, next-generation AI technologies are not only streamlining compliance processes but fundamentally redefining how banks approach governance, risk management, and operational efficiency.

Being an AI development company, App Maisters has been keeping a close eye on these changes to enable banking institutions to utilize the power of AI responsibly and efficiently. This article explores the major trends that are driving compliance automation in banking this year and beyond.

Growing Role of AI — From Experimental Pilots to Core Banking Infrastructure

For years, banks viewed AI as an experimental promise testing tools for fraud detection, customer service, and back-office optimization. In 2025, that tentative period has passed, and strategic adoption took its place. AI is no longer an add-on; it is transforming into a core part of banking operations.

Compliance teams that were once hugely dependent on manual checks of data and human inspection are now using AI models that can ingest and analyze millions of transactions, documents, and communications in real time. Natural Language Processing (NLP) technology can now read and interpret legislation across borders, automatically highlighting any possible breach. Simultaneously, sophisticated Machine Learning (ML) models learn from new instances day in and day out, making sure that compliance systems evolve alongside changing regulations.

This change enables banks to identify anomalies quicker, minimize false alarms, and deploy human scrutiny to the most complicated or sensitive situations. For customers, the advantage is no less substantial fewer delays, fewer invasive verification alerts, and a more seamless banking experience.

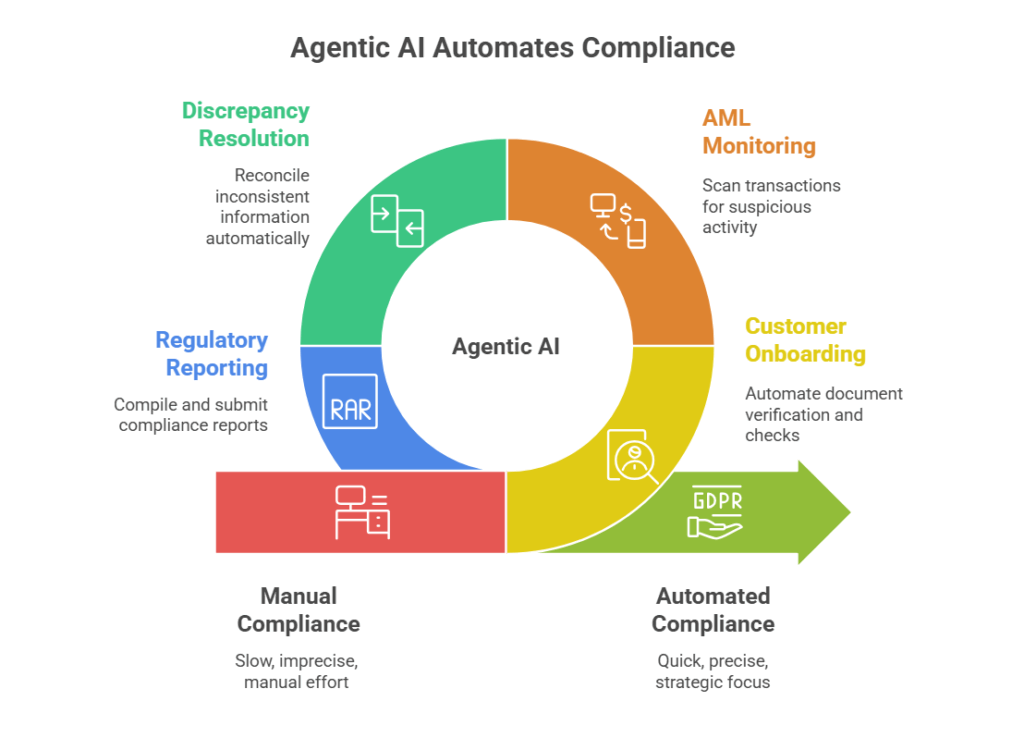

Growing Role of AI — Agentic AI Leading End-to-End Compliance Automation

Perhaps the most thrilling development is agentic AI autonomous AI agents capable of running end-to-end workflows with minimal human intervention. These systems serve as digital compliance officers, doing things like:

- Customer Onboarding & KYC: Automating document verification, background checks, and database cross-referencing.

- AML Transaction Monitoring: Continuously scanning transactions for suspicious activity, adapting thresholds based on new risk patterns.

- Discrepancy Resolution: Identifying and reconciling inconsistencies between declared information and discovered data.

- Regulatory Reporting: Automatically compiling and submitting compliance reports with full audit trails.

Agentic AI is able to orchestrate across systems core banking systems, data repositories, and external APIs making compliance much quicker and more precise. With up to 90% less manual effort, these AI “teams” liberate human personnel to concentrate on strategic choice-making and intricate risk analysis.

Real-Time Compliance and Explainable AI

One of the big obstacles to AI adoption in banking has been the “black box” issue how do you trust an AI decision when you can’t account for how it was reached. The new generation of AI compliance solutions addresses this with explainable AI (XAI).

Explainable AI in compliance does not just report an outcome it reports to the compliance officer why a transaction has been alerted, citing the precise regulatory provision or internal policy that has caused the alert. With real-time processing of data, these models provide instant, evidence-based decision-making. Not only does this instill confidence with regulators but enhance customer transparency too.

Hyper-Automation and Operational Efficiency

Hyper-automation, which combines AI, robotic process automation (RPA), and intelligent workflows, is revolutionizing compliance from a time-consuming function to a lean data-driven process. Banks using hyper-automation are able to:

- Reduce compliance processing times from days to minutes.

- Eliminate redundant manual checks by integrating systems.

- Predict regulatory risks before they occur through predictive analytics.

This shift is particularly valuable in global banking, where cross-border compliance involves navigating multiple regulatory frameworks simultaneously.

Regulatory Landscape and Risk Management

Whereas AI offers velocity and effectiveness, it also poses some new challenges in data governance and regulatory compliance. Governments across the globe are now developing AI-specific regulations, with emphasis on areas like bias protection, algorithmic transparency, and data protection.

In 2025, compliance automation systems must therefore do more than meet financial regulations they must also adhere to AI governance standards. This means:

- Maintaining audit-ready logs of every AI decision.

- Ensuring models are regularly retrained to avoid bias.

- Implementing human-in-the-loop processes for high-risk decisions.

- Protecting sensitive customer data through advanced encryption and privacy-preserving techniques.

Banks that can meet both regulatory and ethical standards will gain a competitive advantage, not only avoiding penalties but also enhancing their reputation for trustworthiness.

Technology Trends Driving Compliance Automation

Several key technologies are accelerating the transformation of compliance automation in 2025:

1. Federated Learning for Privacy

Rather than aggregating all the data into one central server, federated learning learns AI models on local data. This reduces privacy vulnerabilities while enabling banks to take advantage of collaborative learning.

2. Multimodal AI for Broader Insights

Current AI algorithms are now simultaneously processing text, voice, images, and structured transaction data to provide a 360-degree picture of the risk of non-compliance. This is priceless in situations like validating customer identities using both document scans and voice authentication.

3. Predictive Risk Scoring

Future AI codes can now evaluate the likelihood of a compliance failure prior to it occurring, allowing for pre-emptive actions. This encompasses forecasting suspicious pattern of transactions as well as detecting evolving fraud strategies.

4. ESG and Sustainable Compliance

Compliance with Environmental, Social, and Governance (ESG) is being increasingly addressed using AI, ensuring banks achieve sustainability targets in addition to financial standard.

Overcoming Adoption Challenges

Even with the obvious advantages, there has been a reluctance on the part of some banks to adopt full-scale deployment of AI in compliance due to fears of:

- Data Security Risks: Fear of AI systems being targeted by cybercriminals.

- Cultural Resistance: Skepticism from staff accustomed to manual processes.

- Implementation Costs: Perceived high costs of integrating AI with legacy systems.

- Regulatory Uncertainty: Rapidly evolving laws that may change compliance requirements mid-deployment.

Agile banks are overcoming these issues with phased adoption, beginning with hybrid systems where AI performs standard tasks and humans manage exceptions, incrementally adding more AI tasks as trust grows.

Strategic Priorities for Banks and AI Development Companies

For AI to deliver its full potential in banking compliance, both banks and technology partners must focus on:

- End-to-End Workflow Automation: Designing AI that handles entire compliance lifecycles seamlessly.

- Embedded Governance: Building compliance checks into the AI’s architecture from day one.

- Interoperability: Ensuring AI integrates smoothly with existing core banking systems.

- Continuous Learning: Regularly updating AI models with the latest regulatory changes and market patterns.

- Transparent Reporting: Providing clear, regulator-friendly reports to facilitate audits.

Key Takeaway

Next-generation AI is revolutionizing how banks handle compliance in 2025. From autonomous agentic AI to explainable real-time monitoring, the direction is clear: compliance is no longer a regulatory requirement it is becoming a competitive advantage.

As a pioneering AI development firm, App Maisters is in the vanguard of this change. Our products are crafted to match the highest levels of accuracy, transparency, and regulatory compliance while ensuring operational efficiency. Whether your bank is researching hyper-automation, federated learning, or ESG compliance integration, App Maisters offers the proficiency to conceptualize, create, and implement systems that leave you ahead of the regulatory requirements and industry trends.

Through a collaboration with App Maisters, banking and financial institutions are able to transition beyond the conventional weight of compliance toward a future where automation, trust, and flexibility function together in concert transforming compliance as a strategic asset.

FAQs

How is AI transforming banking compliance in 2025?

AI automates compliance checks, detects risks faster, and ensures accuracy. App Maisters develops next-gen AI systems that streamline these processes for banks.

What makes App Maisters a leader in AI compliance automation?

App Maisters combines deep banking expertise with advanced AI development to deliver transparent, scalable, and regulation-ready compliance solutions.

Can App Maisters help integrate AI with our existing banking systems?

Yes. App Maisters specializes in building AI solutions that seamlessly integrate with core banking platforms, minimizing disruption and maximizing efficiency.

How does App Maisters ensure AI-driven compliance is regulator-approved?

App Maisters designs AI with built-in audit trails, explainability, and alignment to the latest banking regulations for full regulator confidence.

Is AI-powered compliance affordable for mid-sized banks?

Absolutely. App Maisters creates modular AI solutions that can scale based on budget, making compliance automation accessible to mid-sized institutions.

What role does App Maisters play in agentic AI adoption?

App Maisters develops agentic AI systems that autonomously handle full compliance workflows from KYC checks to regulatory reporting.

How quickly can banks see results with App Maisters AI compliance solutions?

Banks often achieve measurable efficiency gains within weeks of implementing App Maisters AI-driven compliance platforms.